Éditoriaux de l'Ifri - The European Battery Alliance is Moving up a Gear Edito Energie, May 2019

French battery cell manufacturer Saft and Opel, the German subsidiary of automaker PSA Group, are finalising the details of a major investment project in battery cell manufacturing. Is the European Union (EU) finally challenging Asia’s dominance on battery cells production? What chances of success for the European Battery Alliance (EBA) and what implications for the EU industrial policy?

Back in 2017, the European Commission (EC) warned about the serious risk for Europe to become irreversibly dependent on battery cells imports, for both the roll-out of clean mobility and the stabilization of power grids integrating high shares of variable renewable energy sources. Electrically-chargeable vehicles (EVs) still account for only 2% of new cars registered across the EU throughout 2018[1], but the year-on-year growth rate hit 38.2% and this trend is pitched to continue with the recent agreement on ambitious 2025 and 2030 CO2 emission targets for new cars and vans. Likewise, expected shifts in national electricity mixes, including the German coal phase out, will create substantial flexibility needs and thus strong market opportunities for stationary battery storage.

All conditions are in place for demand to flourish, and yet the value chain risks being mostly non-European, in particular when it comes to battery cells manufacturing. Cells are a strategic component, accounting for about 70% of the costs of the battery pack, which makes up about 35% of the costs of a fully-electrified vehicle. This segment is currently dominated by East-Asian competitors, with Panasonic (Japan) and LG Chem (South Korea) being top manufacturers for the automotive market, closely followed by Samsung SDI (South Korea), CATL (China) and SK Innovation (South Korea).

Responding to a growing demand for lithium-ion battery cells, global production went from just 19 Gigawatt hours (GWh) in 2010 to 160 GWh in 2019. Growth in manufacturing capacity is even more impressive: yearly capacities reached 285 GWh in 2019, up from 30 GWh in 2010.[2] This race for scale stems from the fact that building larger production lines reduces unit costs, thanks to the importance of economies of scale in a number of process steps. The EU is dangerously lagging behind; it represents less than 3% of the global lithium-ion cell manufacturing capacities and production is mainly targeting high-end niche markets, not the automotive sector.[3]

With the launch of the EBA, the EC sent a wake-up call to EU automakers, industrial players from the mining industry to electro-chemistry, research institutes and EU member states. If European stakeholders do not react swiftly and join forces to build a competitive battery value chain, catching up with Asian incumbents will become impossible. Europe would not only miss out on one of the biggest business opportunity of the next decade, but its automotive sector – currently representing 13.3 million jobs or 6.1% of the total EU workforce – would also run the risk of losing ground in the global competition.

The EBA, a bottom-up approach to EU industrial policy

The starting point of the EBA was to recognize that the whole value chain – from raw material supplies to battery recycling – was of strategic interest for the EU. Hence, all existing tools should be used in coordinated way to create an enabling environment, foster cooperation initiatives and facilitate investment decisions. Opting for a “bottom up” approach to industrial policy, the EC mandated InnoEnergy – a public-private partnership supported by the European Institute of Innovation and Technology – to gauge the needs of the industry and identify the main obstacles to investment projects and scaling up strategies.[4]

Following an extensive consultation with the industry, the EC published a “Strategic Action Plan for Batteries” in April 2018. Its 37 action points focus on the increased and more coherent use of existing policies and financial instruments: ensure a reliable access to raw and processed material supplies through free trade agreements and the creation of an attractive investment framework for extraction, refining and recycling activities in Europe; address the lack of specialized skills on applied process design & cell manufacturing; mobilise all support instruments to boost research and innovation efforts on the performance of advanced li-ion battery cell technologies and the possible switch to the next generation of batteries based on solid-state electrolytes; use public finance to de-risk investment projects and facilitate industrial deployment; and finally consider the possible introduction of environmental requirements on the design phase for battery products to be placed on the EU market.

While expanding their EV plans, EU automakers see the importance of having stable and high-quality battery cells supplies, but the automotive industry is used to sourcing parts from external suppliers, and they think their bargaining power with existing cells manufacturers is satisfactory, at least at this point in time. As a consequence, investing billions in gigafactories or subscribing to large off-take contracts with new entrants is not considered a strategic move, knowing that the shift to automated cars is already requiring structural change and massive investments on their part and that cost-competitiveness is a must to kick off EV sales. In short, EU automakers are supportive of the EBA, but the European strategic autonomy will not be the determining factor of theirs cells supply strategy.

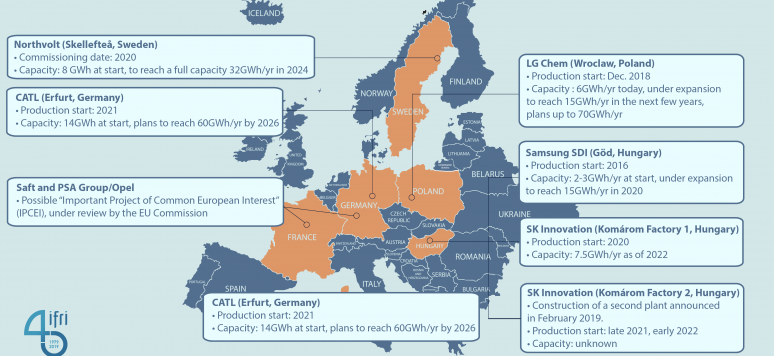

To date, their primary choice has been to require the East Asian incumbents to invest in battery cell production in Europe, i.e. close to their decision centres and consumer base, in order to control the design and the quality of cells, while minimising transport costs. This is leading to the construction of several factories in Germany (CATL), Poland (LG Chem) and Hungary (Samsung SDI, SK Innovation). Conversely, EU project promoters lack customers’ commitments to demonstrate their financial viability and develop sufficient capacity to reach economies of scale, and ultimately deliver high-quality cells without cost overruns or delays. So far, Northvolt, the Swedish-based company is the most advanced European-driven manufacturing project. A pilot line is under construction and the next step would be to complete the first section of the factory in 2020 and produce 8 GWh/yr. In short, the EBA is facing a dual challenge: ensuring that enough gigafactories are in the European pipeline to avoid shortages when EV demand takes off, while also breaking the chicken-and-egg problem for new European entrants.

The European battery industry is finally taking off

Despite the EU’s efforts, the wait-and-see approach has so far prevailed, but things may be about to change. If EVs are the lion’s share of future profits, automakers cannot consider high-performing battery cells as pure commodity products, with ample supplies guaranteed and little potential for differentiation. There is a chance that they will want more than geographic proximity and try to get directly involved in battery cells production. In fact, the risk of shortages in tier one battery cells is already becoming a strong concern among EV makers. For example, Tesla has recently confirmed that it was struggling to ramp up production of its Model 3 because the actual cells output – of which Panasonic is in charge – had reached only 2/3rd of the theoretical 35 GWh/yr capacity of the Nevada gigafactory.[5]

This strategic shift is confirmed by various recent announcements: Toyota is creating a (51:49) battery cells joint venture with Panasonic in China and Japan; BMW is opening a second battery chemistry lab in Germany; Volkswagen has launched a “Battery Union” with Northvolt and other partners from seven Member States to conduct joint research activities covering the entire value chain. Automakers are strengthening their competence on battery cells, to at least improve their negotiating position with the leading manufacturers or potentially to prepare for a more direct involvement in gigafactory projects. The challenge for them is to keep good relations with their current suppliers, while also exploring a wider set of options for when their EV production changes scale.

This is a wide open game and Member States are now taking a much more active stance in the promotion of EU-made battery cells, including through the provision of public finance. According to EU legislation, state assistance can be used to de-risk investment in large, highly-innovative and transnational projects. Batteries have been identified as one of the nine values chains of strategic importance for the EU industrial competitiveness and decarbonisation, confirming the EC’s willingness to approve state-aid schemes for battery manufacturing projects. At this stage, Belgium, France, Germany and Italy have launched calls for interest to identify possible consortia under this framework of “Important Projects of Common European Interest”. Germany promised up to €1bn euros to help kick-start battery cells production, while France committed to support the battery value chain with a €700m action plan. Taxpayers’ money is made available and there are many candidates; six different consortia involving about 30 different companies have applied for funding under the German call alone.[6] One of the main difficulty is to agree on a fair geographical distribution of activities among the Member States and industry partners involved. France and Germany have now sent a letter of intent to the EC, to obtain green light on their financial support to an investment project involving Saft and PSA Group/Opel. Several other industrial consortia should be announced in the coming weeks and the European Investment Bank is also expected to grant additional support to the Northvolt gigafactory project in Sweden.

Playing the European card: which priority goals?

The EBA has set a target of 200 GWh/yr manufacturing capacity to be available in the EU as of 2025, while others believe the European EV market will need 500-600 GWh/yr by 2030, or at least ten gigafactories of the size of the one developed by Tesla-Panasonic in Nevada.[7] These estimates confirm that there is room for many foreign and European investment projects to go ahead, hopefully covering the highest number of Member States.

Targeting an “Airbus for batteries” or an exclusively European battery industry is not the way forward. Global automakers serving the European market (Ford, Nissan, Toyota, etc.) may decide to partner with European cells manufacturers. Conversely, EU car makers may favour non-European incumbents, while playing a more active role through the establishment of joint ventures. It is also worth reminding that Korean firms leveraged licenses from Japanese manufacturers while China’s giant battery cells maker, CATL, is a former subsidiary of TDK, a Japanese producer of consumer electronics batteries. The highest barriers to market entry are the incumbents’ accumulated tacit knowledge and long-term partnerships across the value chain.[8] Since the European industry has no experience with large-scale cells manufacturing, incentivizing international partnerships and involving non-European stakeholders will create high-quality jobs and develop the know-how. An open and progressive approach may be the only credible way to catch up with market leaders.

On the other hand, the European Battery Industry must take the lead in designing and producing the most environmentally-sustainable and ethically-responsible products, while ensuring that the highest recycling rates possible are achieved. Battery manufacturing is energy-intensive (70-80 kWh needed to produce a 1 kWh battery capacity), and it is based on a number of critical raw materials that are predominantly sourced outside of Europe under poor traceability systems. If EVs are to become the cornerstone of Europe’s clean mobility strategy, there is a strong case for introducing minimum sustainability requirements on the production phase and promoting commitments on ethical sourcing of raw materials as part of an equally strategic approach for critical metals supplies.[9] Preparatory work is under way at the EU level and initial results demonstrate the complexity of integrating the circular economy principle, life-cycle assessments and socio-economic considerations in the legislative framework.[10] It is adamant that the initiative remains at the highest level of the EU’s agenda and that practical obstacles are overcome.

Finally, it is important to acknowledge the limits of the EBA’s “bottom up” approach and to go back to the fundamental debates around EU industrial policy and the strategy vis-à-vis China. The country represents more than half of the global EV market and the introduction of mandatory EV quotas could double annual sales (from 1 to 2 million) within the next two years. The EU’s efforts will never match China’s ambitions and level of direct and indirect State-support. Without a fair access to the booming Chinese market, European companies are bound to struggle in the global EV competition and this is a major weakness of the EBA. The EU should not wait for a hypothetical reform of the World Trade Organisation and explore alternative options to remove unfair barriers to overseas markets.

[1]. ACEA, “Economic and Market Report : EU Automotive Industry Full-year 2018”, February 2019, available at: www.acea.be [1].

[2]. Benchmark Mineral Intelligence, « Megafactories Tracker », available at : www.benchmarkminerals.com [2].

[3]. N. Lebedeva, D. Di Persio and L. Boon-Brett, “Lithium-ion Battery Value Chain and Related Opportunities for Europe”, Joint Research Center, February 2018, available at: http://publications.jrc.ec.europa.eu [3].

[4]. D. Pavia, “European Battery Alliance: A Concrete European Industrial Policy Case »,

The European Files, 12 February 2019, available at: www.europeanfiles.eu [4].

[5]. C. Trudell and P. Alpeyev, “Musk Blames Panasonic Battery Lines for Tesla Ouput”, Bloomberg, 14 April 2019, available at: www.bloomberg.com [5].

[6]. C. Randall, “Six Consortia Want to Build Battery Cells in Germany”, Electrive, 14 March 2019, available at: www.electrive.com [6].

[7]. D. Reintjes, “Europe Will Have at Least Ten Gigafactories, Says Battery Boss”, Euractiv, 5 April 2019, available at: www.euractiv.com [7].

[8]. M. Beuse, T.S. Schmidt and V. Wood, « A Technology-Smart Battery Policy Strategy for Europe », ScienceMag, September 2018, Vol 361, Issue 6407

[9]. M.A. Eyl-Mazzega and C. Mathieu, “Strategic Dimensions of the Energy Transition: Challenges and Responses for France, Germany and the European Union”, Études de l’Ifri, Ifri, April 2019, available at: www.ifri.org [8].

[10]. European Commission, “Preparatory Study on Ecodesign and Energy Labelling of Rechargeable Electrochemical Batteries with Internal Storage”, November 2018, available at: https://ecodesignbatteries.eu [9].