3364 publications

The Global Economy: Caught in the Storm / Politique étrangère, Vol. 91, No. 1, 2026

The global economy has become the primary arena for the clash of power ambitions in a world where understanding, coordination, and concerted multilateralism seem to have been permanently marginalized. In this fragmented landscape, how will American and Chinese strategies interact? Will the European Union manage to break out of its decades-old framework in order to face new competition? And will it be able, like others, to integrate the announced shift from a production economy to a digital, information economy? And what role will financial institutions, and central banks in particular, play in this transitioning international economy?

Bundeswehr: From Zeitenwende (historic turning point) to Epochenbruch (epochal shift)

The Zeitenwende (historic turning point) announced by Olaf Scholz on February 27, 2022, is shifting into high gear. Financially supported by the March 2025 reform of Germany’s “debt break” and backed by a broad political and societal consensus to strengthen and modernize the Bundeswehr, Germany's military capabilities are set to rapidly increase over the coming years. Expected to assume a central role in the defense of the European continent in the context of changing transatlantic relations, Berlin’s military-political position on the continent is being radically transformed.

Russia, the Palestinians and Gaza: Adjustments after October 7th

The Soviet Union (USSR), and subsequently the Russian Federation as its internationally recognized legal successor, has consistently sought to play a visible role in efforts to resolve the Israeli-Palestinian conflict.

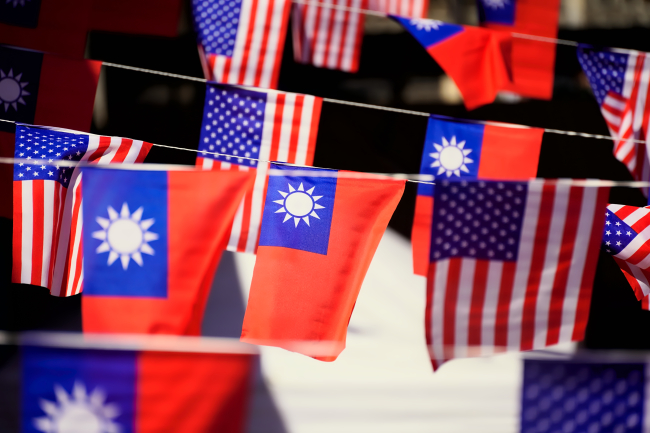

The U.S. Policy Toward Taiwan Beyond Donald Trump: Mapping the American Stakeholders of U.S.-Taiwan Relations

Donald Trump’s return to the White House reintroduced acute uncertainty into the security commitment of the United States (U.S.) to Taiwan. Unlike President Joe Biden, who repeatedly stated the determination to defend Taiwan, President Trump refrains from commenting on the hypothetical U.S. response in the context of a cross-Strait crisis.

Mapping the MilTech War: Eight Lessons from Ukraine’s Battlefield

This report maps out the evolution of key technologies that have emerged or developed in the last 4 years of the war in Ukraine. Its goal is to derive the lessons the North Atlantic Treaty Organization (NATO) could learn to strengthen its defensive capabilities and prepare for modern war, which is large-scale and conventional in nature.

Japan’s Takaichi Landslide: A New Face of Power

Prime Minister Sanae Takaichi has turned her exceptional popularity into a historic political victory. The snap elections of February 8 delivered an overwhelming majority for the Liberal Democratic Party (LDP), driven by strong support from young voters, drawn to her iconoclastic and dynamic image, and from conservative voters reassured by her vision of national assertiveness. This popularity lays the foundation for an ambitious strategy on both the domestic and international fronts.

Mind the Deterrence Gap: Assessing Europe’s Nuclear Options

Europe must urgently confront a new nuclear reality. In recent years, Russia’s nuclear-backed revisionism has reintroduced nuclear coercion and the threat of nuclear escalation to the continent, underscoring the importance of credible nuclear deterrence. At the same time, Europe’s traditional reliance on US extended nuclear deterrence appears politically more fragile than at any point since the Cold War. Together, these developments require Europeans to think about their nuclear options.

Deathonomics: The Social, Political, and Economic Costs of War in Russia

The report attempts to outline and examine a truly new phenomenon in Russian society, dubbed “deathonomics”—the making of a mercenary army against the backdrop of the Kremlin’s war in Ukraine, eventually replacing both the Soviet (conscript) and early new Russian (contract) armies. It notes that, by the end of 2023, this trend had turned the military service into one of the highest-paying professions in the country, something not seen in Russia on such a scale since the late 17th century.