The Strategic Repositioning of LNG: Implications for Key Trade Routes and Choke Points

2022 saw the climax so far of the weaponization of energy. Following its geopolitical demise, Russia has undertaken its own gas amputation, moving from a super energy power status to a diminished role with uncertain prospects and only hard options left.

Russia has cut off almost entirely pipeline gas supplies to the European Union (EU), first inflicting huge financial pain and collecting record high revenues, but then simply losing out its largest and best market with no realistic alternative, and no prospect of any significant return. However, the Kremlin could still further reduce some of the remaining pipeline gas or liquefied natural gas (LNG) supplies and thus cause some tensions in the markets. Russia also retains leverage on oil markets, where the Kremlin managed to cope with the embargo as well as the price cap and maintain the relationship with Saudi Arabia which drives OPEC+ decisions.

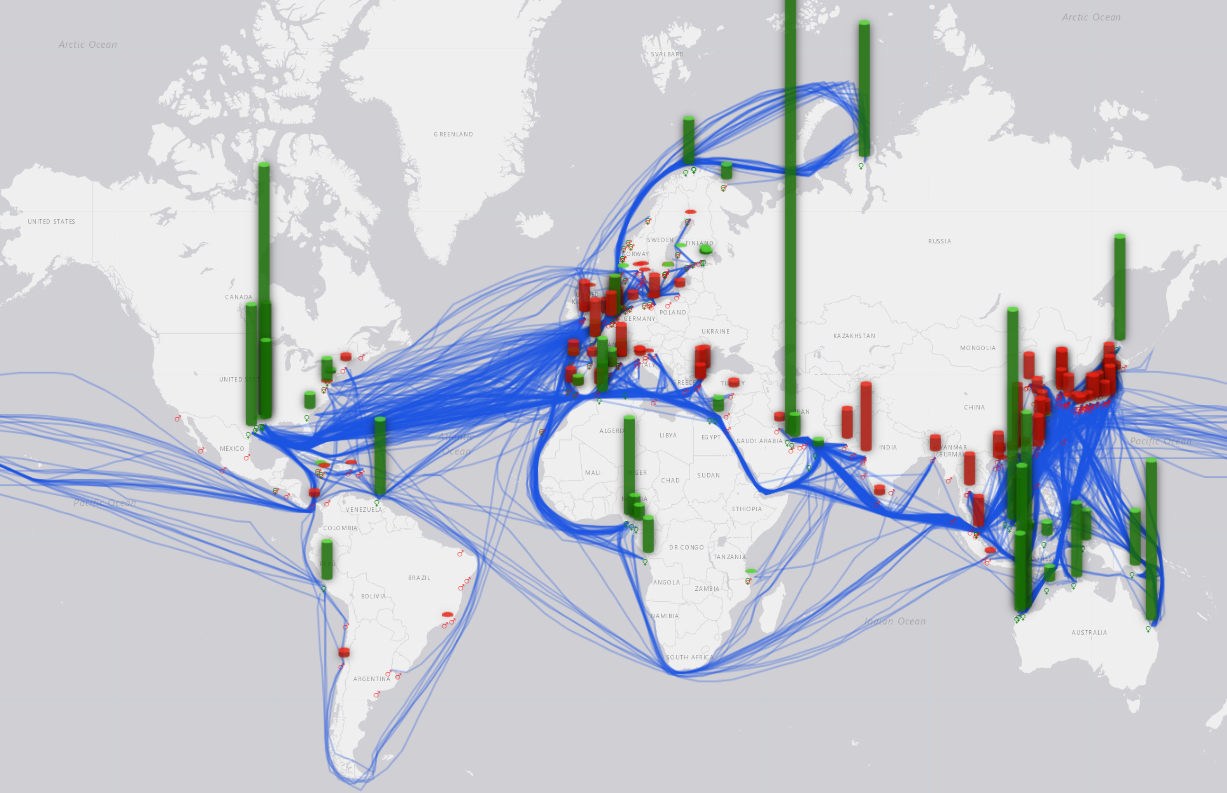

Meanwhile, in 2022, the European energy system has managed to surprisingly adapt on the supply and demand side to the three shocks: the decoupling from Russian energy supplies, the hydropower generation crisis, and the French nuclear electricity crisis. Liquefied natural gas has made a comeback in Europe and has been a savior of industries, governments, and populations. The LNG corridor between the EU and the United States (U.S.) has become the most dominant LNG trade route in 2022. This came at a huge cost though – EU’s gas import bill soared ten times from 2020 and three times from 2021 levels.

For 2023, the European gas balance is much more fragile, as the demand reduction potential has reached its limits, same for the ability to attract additional non-Russian exports to Europe, at a time when missing Russian volumes will probably reach 120 billion cubic meters (bcm), instead of about 77 bcm in 2022. More moderate price levels since November 2022 have clearly overshadowed this fundamental mismatch, especially as the weather has been mild and China was still struggling with the pandemic.

With an additional 30-40 bcm of missing Russian gas to offset in 2023 compared to 2022, Europeans can be expected to benefit from an extra gas of around 20-25 bcm left in storages thanks to mild weather and available LNG. They have no choice but to continue saving energy in a hurry, that is both on gas and electricity. Gas demand in power generation had increased in the first nine months of 2022 before falling in Q4 2022, and well over 15 bcm can be saved here in 2023 as more nuclear is available altogether, alongside more renewables, and some coal. It will be critical to reduce peak loads though. The key improvement is in terms of logistics, with the massive new LNG import capacity deployed across Europe.

Overall, EU’s import situation will be very tensed and fragile for the next winter. The key challenge is that EU’s gas supply security ultimately depends on the weather in Europe, China’s and Japan’s LNG demand, and weather or technical outages in the Gulf of Mexico or in other producers. Any slight disruptions in supplies can have major impacts. As a last resort, bringing back some Groningen supplies, no matter how politically sensitive this would be, must be considered and prepared. Large financial compensations and effective governmental action would notably be required to offset the hardships.

Available in:

Regions and themes

ISBN / ISSN

Share

Download the full analysis

This page contains only a summary of our work. If you would like to have access to all the information from our research on the subject, you can download the full version in PDF format.

The Strategic Repositioning of LNG: Implications for Key Trade Routes and Choke Points

Related centers and programs

Discover our other research centers and programsFind out more

Discover all our analysesDeathonomics: The Social, Political, and Economic Costs of War in Russia

The report attempts to outline and examine a truly new phenomenon in Russian society, dubbed “deathonomics”—the making of a mercenary army against the backdrop of the Kremlin’s war in Ukraine, eventually replacing both the Soviet (conscript) and early new Russian (contract) armies. It notes that, by the end of 2023, this trend had turned the military service into one of the highest-paying professions in the country, something not seen in Russia on such a scale since the late 17th century.

Russia's Asia Strategy: Bolstering the Eagle's Eastern Wing

Among Russia’s strategic priorities, Asia traditionally played a secondary role compared to the West. In the mid-1990s, then Foreign Minister Yevgeny Primakov initiated a rapprochement with China and India. Then, in 2014, deteriorating relations between Russia and the West prompted Moscow to begin its “great pivot to the East”.

Kazakhstan After the Double Shock of 2022: Political, Economic and Military Consequences

The year 2022 represented a dual shock for Kazakhstan. In January, the country faced its most severe political crisis since independence, followed in February by Russia’s full-scale invasion of Ukraine, which cast uncertainty over the borders of post-Soviet states. These consecutive crises profoundly shaped Kazakhstan’s domestic and foreign policy.

How the Russian Army Changed its Concept of War, 1993-2022

The traditional and high-intensity war that has occurred in Ukraine since Russia decided to invade raises a key issue: did post-soviet Russian strategic thought really prepare Russia for waging this war?