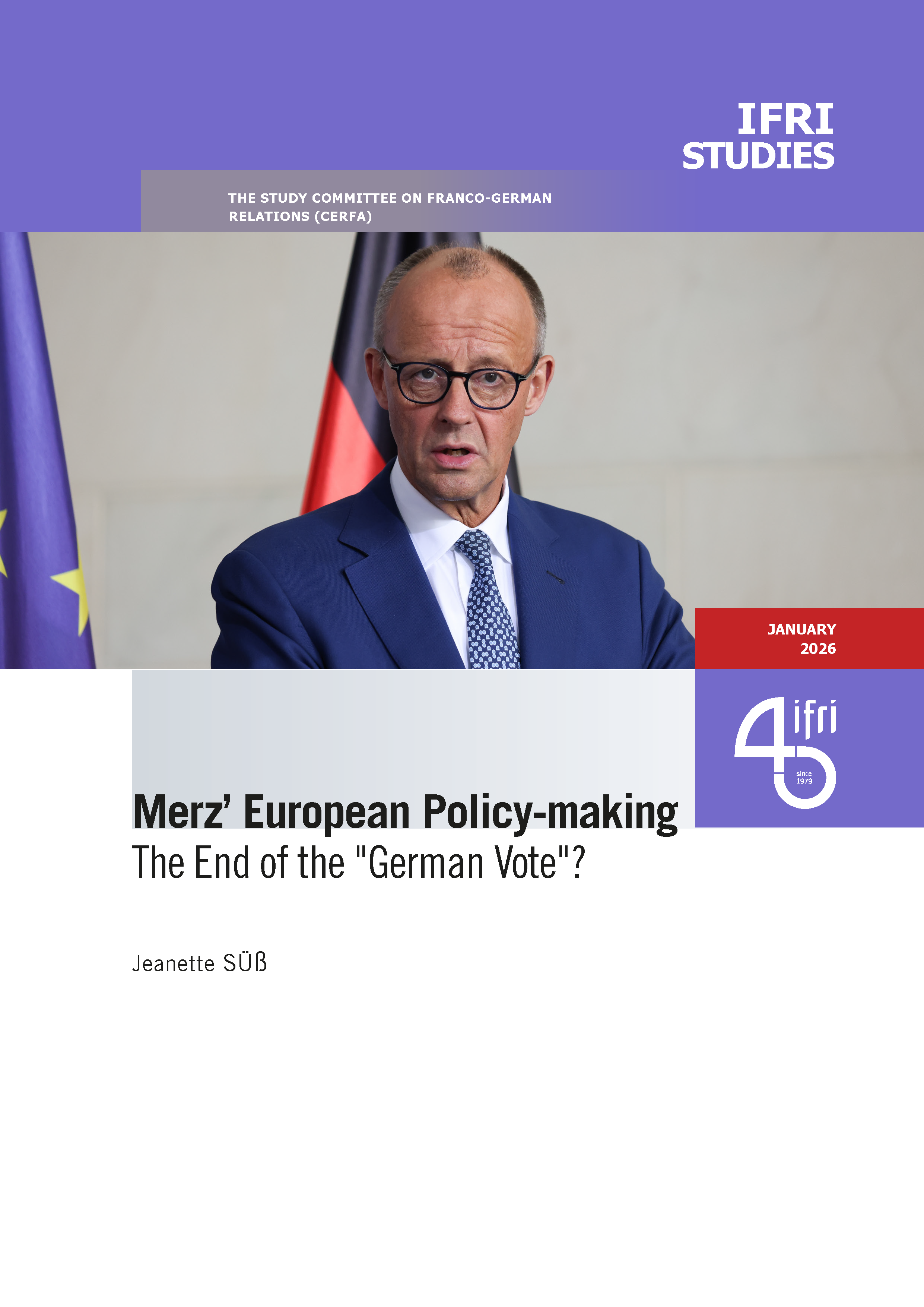

The Gulf Countries' Energy Strategies: What's on the Menu for the Power Sector?

The futuristic green city of Masdar in the United Arab Emirates or the latest announcements of Saudi Arabia which might now well become the new Eldorado for solar energy companies have a clear marketing varnish. But if they are showcases of green ambitions, they nonetheless reflect the situation the Gulf States face today driven by the development of heavy industry and petrochemicals but first and foremost by the rapid population growth (around 2% for Saudi Arabia and 3% for Kuwait; Qatar and the Emirates have higher population growth rate due to immigrants).

Demand for power is rising as fast as buildings, even more so as most of the water consumed is desalinated. While their economies still largely depend on oil and gas revenues, burning increasing amounts of fuels domestically into power stations is not sustainable. These countries are facing an energy paradigm with serious implications. Faced with this challenge, the Gulf States are thinking of solutions. They are moving at different speeds towards the diversification of power generation sources and the restructuration of their power sector. Recent years have therefore evolved under the banner of reform and a strong institutional activity in most states.

This comparative study intends to evaluate the energy paradigm in the GCC, and the responses given by some of the monarchies. This paper is written in the middle of the reform process, and therefore does not claim to evaluate the results of these measures. Rather it looks at the speed at which these reforms are being undertaken, the tools used and advantages across the countries, and the type of reforms that are conducted. It focuses on three specific countries: Saudi Arabia, the UAE and reports on other states to a lesser extent. The final section assesses the impact of the economic crisis and the regional political turmoil on the reform process. This paper argues that while high oil prices provide a large tax base for states investments in new and alternative power generation, the fear of the contagion of political turmoil will slow the privatization process and hamper price reforms. Additionally, the global credit crunch could have a negative impact on power plants tenders.

Available in:

Regions and themes

ISBN / ISSN

Share

Download the full analysis

This page contains only a summary of our work. If you would like to have access to all the information from our research on the subject, you can download the full version in PDF format.

The Gulf Countries' Energy Strategies: What's on the Menu for the Power Sector?

Related centers and programs

Discover our other research centers and programsFind out more

Discover all our analysesPlacing the EU on a Warfare Footing: Energy and Raw Materials Priorities for 2026

The year 2025 has confirmed that one must prepare for much worse in the field of geopolitics and geoeconomics as the intensity and frequency of shocks increase and as the European Union (EU) has no more stable flanks now that crises with the United States (US) become so frequent and reveal a systemic rift. In the world, barriers to trade multiply and dependencies are weaponized.

Brazil One Year Away from the October 2026 General Elections

Brazil’s general elections will be held on October 4, 2026, to elect the president, vice-president, members of the National Congress, governors, deputy governors and state legislative assemblies. For the presidential and gubernatorial elections, a second round will be held on October 25 if no candidate obtains a majority of the votes in the first round.

COP30: An Inflection Point for Climate Action and Governance

The 30th Conference of the Parties (COP30), opening in Belém, Brazil, on November 10th 2025, convenes at a perilous moment.

The Strategic Dimension of Skills in the Clean Industrial Deal

In the competitiveness and energy transition battles, the European Union (EU) must master a determinant factor: skills.