Europe

Europe is described here in a geographical sense. It is not limited to the European Union, and includes, for example, the United Kingdom and the Balkans. It remains central to international relations.

Related Subjects

Mapping the MilTech War: Eight Lessons from Ukraine’s Battlefield

This report maps out the evolution of key technologies that have emerged or developed in the last 4 years of the war in Ukraine. Its goal is to derive the lessons the North Atlantic Treaty Organization (NATO) could learn to strengthen its defensive capabilities and prepare for modern war, which is large-scale and conventional in nature.

French public opinion on China in the age of COVID-19: Political distrust trumps economic opportunities

This report is a result of a wide-scale study of public opinion on China in 13 European countries,1 conducted in September and October 2020, on the research sample representative with respect to gender, age, level of education, country region, and settlement density. Here, we focus on the French portion of the polling, building on the previously published report comparing the results across the 13 countries.

The Franco-German Armaments Cooperation. An Impossible Agreement?

In the Aachen Treaty in 2019, Germany and France agree to deepen their "common program in defense matters" and to pursue a common vision in terms of arms export. These are the preconditions that will help consolidate a culture of common armed forces, common interventions, and European defense industry.

The Future of Europe in the Context of Sino-American Competition

This special issue of Politique étrangère focuses on the proceedings of the Conference organized by the French Institute of International Relations (Ifri) for its 40th anniversary, held on April 10th, 2019, in Sorbonne University's Grand Amphithéâtre.

The American Elections and Beyond

The next few years will be tumultuous ones in the United States. The dependency of foreign policy on domestic policy is unlikely to diminish. Whether in the rivalry with China or the predominance of Israeli interests in Middle East policy, for example, it is hard to imagine Biden taking a big step backward. Many Europeans want to believe that a victory by Obama’s former vice president will signal a return to the good old days of transatlantic consultation and multilateralism.

Towards Tougher Bilateral Relations Between EU and China

When politics catches up to the economy. In the wake of the EU-China summit, what can we expect from the bilateral relations? 2020 was supposed to be the year of EU-China relations. However, the Covid-19 pandemic has quickly disrupted the positive expectations.

Europe beyond COVID-19

The recovery plan agreed upon by European Union leaders in July 2020 is unprecedented: for the first time, it creates a common debt that will help revive the economies impacted by the pandemic.

RAMSES 2021. At the Edge?

RAMSES 2021. At the Edge?, written by Ifri's research team and external experts, offers an in-depth and up-to-date analysis of geopolitics in today’s world.

Shaping the future of the EU: reviving the Europeanisation process

More than ten years after joining the European Union (EU), the Central and Eastern European countries (CEECs) exhibit a puzzle of attitudes and conceptions regarding the EU.

The European Equation of Nuclear Deterrence, Variables and Possible Solutions

Ever since nuclear weapons were developed by the United States and the Union of Socialist Soviet Republics, Europe has lived under the nuclear shadow. A major direct confrontation between “the West” and “the East” could have very likely resulted in the detonation of nuclear weapons on the continent. As the Cold War ended, massive reductions in the US and Soviet arsenals (from 70,300 in 1986 to 13,890 in 2019) and a new security architecture radically transformed the European security environment.

In search of a common spirit: the countries of the Weimar Triangle in the Covid-19 crisis

The coronavirus crisis has affected the countries of the Weimar Triangle to varying degrees. Bilateral relations between Germany and Poland as well as Germany and France have been strongly influenced by border closures, which have led to tensions between the countries.

China vs. USA: After South China Sea, the Arctic as a Second Act

The focus on the power confrontation between China and the U.S. has for a while been directed towards the South China Sea, but a focus should be given to the Arctic region, where the second act is already ongoing.

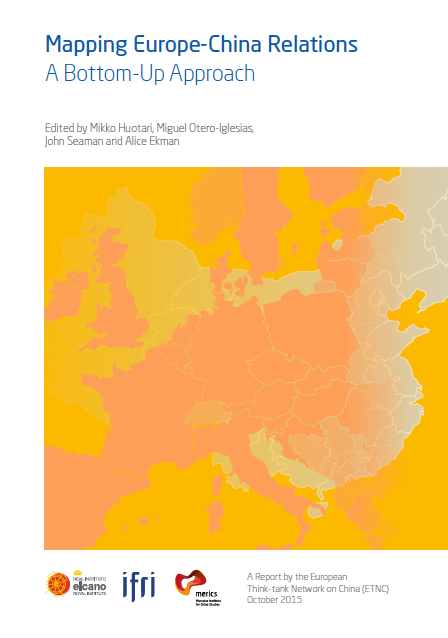

Mapping Europe-China Relations: A Bottom-Up Approach. A Report of the European Think-tank Network on China ETNC, October 2015

As China’s rise continues to shape and shake the course of international affairs, and Europe enters a new chapter in its collective history, Europe-China relations are becoming more relevant, but also much more complex.

EU Reform: Mapping out a state of flux

“EU Reform” is widely discussed across Europe but rarely defined. This report analyses how the 28 member states of the European Union understand “EU reform” and provides an insight into how their views might play out in debates on the future of the EU as well as on day-to-day politics.

European Defence: Minilateralism is not the enemy

To access the whole publication, please click on this link.

Space in a Changing Environment: a European Point of View

The development of European space activities has long been pursued under the framework of the European Space Agency and other national space agencies. More recently, the emergence of the European Union as a new actor for space has paved the way for a series of initiatives and opportunities.

European Defense Revisited / The United Kingdom and the EU: in or out?

A New Era for the European Council ?

Donald Tusk is set to make his mark as the new president of the European council. How will this be felt across the other institutions that make up the EU?

Juncker's 'last chance' Commission: Can he deliver?

Jean-Claude Juncker has made a surprisingly strong start. But behind the clear priorities and the innovative team set-up, his ability to restore trust in the EU remains to be seen.

Greenland and Iceland: Meeting Place of Global Powers in the Arctic

At the crossroads of American, European and Asian interests in the Arctic, Greenland and Iceland, the importance of which had for too long been underestimated, are set to play a central role in future regional developments. In order to exploit the potential of their growing economic ties with Asia, without becoming the Arctic “weak links”, Greenland and Iceland need to secure their economy on a long-term basis.

NSA Does the Grand Tour

On Tuesday Barack Obama called President Francois Hollande of France to explain the National Security Agency’s massive surveillance of French government offices, businesses and private citizens. Obama stated that this was a well-meaning attempt to protect both countries from Islamic terrorism. He offered to “reexamine” the program so as to determine whether the right balance was struck between public safety and privacy rights.

Support independent French research

Ifri, a foundation recognized as being of public utility, relies largely on private donors – companies and individuals – to guarantee its sustainability and intellectual independence. Through their funding, donors help maintain the Institute's position among the world's leading think tanks. By benefiting from an internationally recognized network and expertise, donors refine their understanding of geopolitical risk and its consequences on global politics and the economy. In 2025, Ifri supports more than 80 French and foreign companies and organizations.