Oil rent and Corruption : the case of Nigeria

This study analyses the various mechanisms that explain the leakage of the main source wealth in Nigeria at all levels of the production and commercialization of oil and gas, from the wellheads, with the bunkering of pipelines, up to the export of crude oil and the import of refined products, including through capital flight to tax havens.

The US Oil Embargo on Iran: A New Oil Shock?

The 14 July 2015 Vienna agreement on Iran’s nuclear activities (Joint Comprehensive Plan of Action – JCPoA) was a game changer on the geopolitics in the Middle East and for the oil market. The oil sanctions were lifted and Iran increased significantly its production and exports. On 8 May 2018, President Trump announced that the United Stated (US) would withdraw from the agreement. Financial sanctions were reintroduced. From 5 November 2018 onwards, further sanctions will be re-imposed more specifically on petroleum related transactions, including the purchase of petroleum, petroleum products and petrochemical products. What could be the impact of this new embargo? Is there a risk of a new oil supply and price shock?

Brexit, Electricity and the No-Deal Scenario: Perspectives from Continental Europe, Ireland and the UK

When it comes to energy and electricity in particular, there can be no winner in the Brexit negotiations. The only reasonable objective should be to minimise losses and avoid trade friction.

Japan’s Hydrogen Strategy and Its Economic and Geopolitical Implications

With the Basic Hydrogen Strategy (hereafter, the Strategy) released on December 26, 2017, Japan reiterated its commitment to pioneer the world’s first “Hydrogen Society”. The Strategy primarily aims to achieve the cost parity of hydrogen with competing fuels, such as gasoline in transport and Liquified Natural Gas (LNG) in power generation.

Xi Jinping’s Institutional Reforms: Environment over Energy?

During its two sessions (lianghui) in March 2018, the National People’s Congress (NPC) announced China’s most important institutional reforms in the last 30 years. These changes occurred right after Xi Jinping consolidated his power and at a time when stakeholders working in the energy field were expecting more clarity on policy orientations.

The Trump-led Trade War with China: Energy Dominance Self-destructed?

Under particular US legal rationale, such as calling foreign imports a “national security threat”, President Donald Trump has started imposing tariffs and/or quotas and has launched national security investigations on a growing number of imported goods from US allies and others alike.

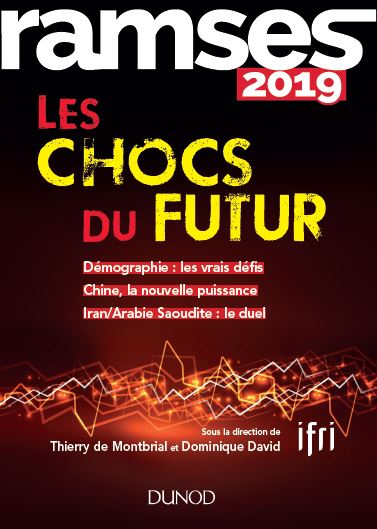

RAMSES 2019. The Clashes of the Future

RAMSES 2019. The Clashes of the Future, written by Ifri's research team and external experts, offers an in-depth and up-to-date analysis of global geopolitics.

Adjustment Is Back: The Political and Financial Crisis in Central African Oil-Producing Countries. Gabon and Congo-Brazzaville

This paper aims to highlight both the financial, economic and political adjustment cycle, affecting two Central African petro-states, Gabon and the Republic of Congo (Congo-Brazzaville).

The Expansion of Offshore Wind Power in the North Sea: A Strategic Opportunity for the European Union

The North Sea is the cradle of the global offshore wind industry. The favourable wind patterns in the Southern part and the low depth of water have created an enabling environment for the construction of the first wind turbines in the world. Public policies have progressively encouraged their deployment in the best-endowed countries: Belgium, Denmark, Germany, the Netherlands and the United-Kingdom.

Navigating the Storm: ‘OPEC+’ Producers Facing Lower Oil Prices

On 22 June 2018, “OPEC+” oil Ministers (Organisation of Petroleum Exporting Countries members and an ad hoc alliance with several non-OPEC producers, notably with Russia, Kazakhstan and Azerbaijan) will gather in Vienna to discuss the status and future of their production limitation agreement which was initiated in November 2016 and runs until the end of December 2018.

Getting Carbon Out: Tougher Than it Looks. An Assessment of EU, US & Chinese Pledges

This paper intends to examine the emissions trajectories of the three largest emitters, China, the US and the European Union through the optics of indicators and assess the feasibility of their targets for 2020.

Oil Markets Range-bound?

We have heard admonitions about peak oil and that we have already passed the geologic peak of world oil production capacity. On the other hand, the IEA warns that if we continue our present patterns of energy consumption, we will need the equivalent of four Saudi Arabia’s in new oil production capacity by 2030 - seemingly at ease that the oil is geologically out there.

Support independent French research

Ifri, a foundation recognized as being of public utility, relies largely on private donors – companies and individuals – to guarantee its sustainability and intellectual independence. Through their funding, donors help maintain the Institute's position among the world's leading think tanks. By benefiting from an internationally recognized network and expertise, donors refine their understanding of geopolitical risk and its consequences on global politics and the economy. In 2025, Ifri supports more than 80 French and foreign companies and organizations.